Top 7 Best Accounting Software in 2023

Table of Contents

Today, the finance sector is growing rapidly, and with its vast development, it is becoming much more difficult to manage various financial tasks and responsibilities. Simultaneously, it is important to note that there are various levels of complexities involved in handling the financial reports, preparing data sheets, and verifying the statistics, related to the monetary gains and losses.

Table of Contents

Not only this, it encompasses a wide range of primary duties that have to be followed with due diligence. Hence, it is clear that operating a financial organization is not an easy task, and requires tremendous effort.

Moreover, professional accountants take the help of accounting software to make their work easy and manage financial projects with great efficiency.

This blog post shall provide you with a deep analysis of the best accounting software prevalent in modern times.

Accounting Software in 2023

As we highlighted above, heavy burdens on financial organizations to perform different functions are certainly difficult to handle. So, in this section, we will talk about the 7 best accounting software in 2023.

It shall help you to identify an appropriate source to manage your financial database to a large extent.

Although, it must be clear that human efficiency cannot be undermined anyhow. Without human endeavors, positive results cannot be yielded. Moreover, these accounting software can be treated as qualitative solutions for providing huge help to automate the various processes involved in

- Financial transactions

- Data entry

- Organizing financial reports

- Maintaining regular data

- Invoicing

- Reconciliations, etc.

Now, let’s take a look at the finest accounting software in 2023.

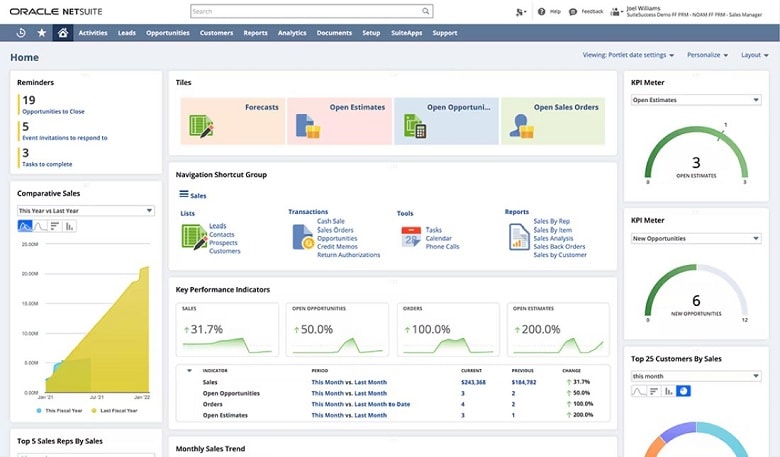

NetSuite

It is a cloud-based application that provides a suite of-

- Enterprise Resource Planning sources

- Monetary dealings

- Logistics

- Human resources procedures

- Efficient automation of the operations

- Cross-channel, etc.

It aims at aligning all the accounting procedures at one source and creating the latest data. NetSuite provides a wide scope of development to beginning businesses, rapidly developing enterprises, community-based and moderate industries, and Private Equity or Venture Capital businesses.

It instantly helps minimize human endeavors, makes data performance better, strengthens the flow of data in a systematic manner, and regularly adheres to the principles and core aspects.

Top Advantages of NetSuite

- Attain full flexibility and relaxation in regard to handling monetary dealings.

- Enhanced procedures with uplifted accounts collectible tools.

- Decreases time utilization and helps escape the delayed fees payable on accounts.

- Arrange regional and worldwide tax handling specifications.

- Utilizes a completely integrated permanent assets remedy.

- Upgrade collections and decrease retailing outstanding.

Cost-Structure

NetSuite offers fixed charges on its services related to managing the financial database of a company.

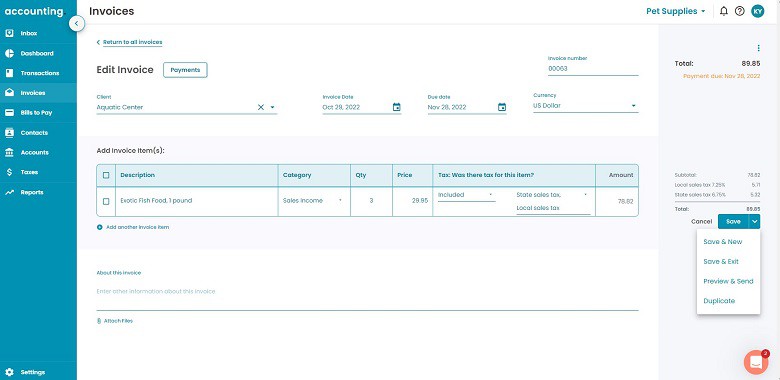

QuickBooks

It is a cloud accounting application that provides a huge benefit to self-reliant consumers and miniature to middle-sized businesses. It is also an effective tool for various enterprises, such as sales, eateries, charitable institutions, etc.

This source provides practical analysis, enhanced reporting consistency, automatic billing, and customizable bill designs. It acts as an efficient source for hosting various consumers while safeguarding your information and also establishes flexible cooperation between employees or cashiers.

Additional facilities can be also accessed from them, such as live accounting, compensation, retail terminal, and time analysis.

Top Advantages of Quickbook

- Simply create data rough figures, and sheets, and provide a deep analysis

- Systematically present the invoices and connected applications for minimizing the human efforts in handling cash flow.

- Handles the payroll, promoting the uninterrupted deposits.

- Enhance activities with the inventory calculator and automated GPS continuance analysis.

- Classify retail tax and help in subtracting the tax.

- Adjoins data from Quickbooks for making a consumer database.

- Provide worldwide transactions with multi-currency extended help.

Cost-Structure

Quickbooks provide a wide range of plans for various business sizes. These plans vary from $30/month to $200/month. It also has a self-reliant or independent dealer plan, which can be accessed at $15/month.

However, it should be clear that the retailer provides a free trial of 30 days, and new consumers attain 50% off their subscriptions. But this is a limited pack that can be accessed only for the first three months.

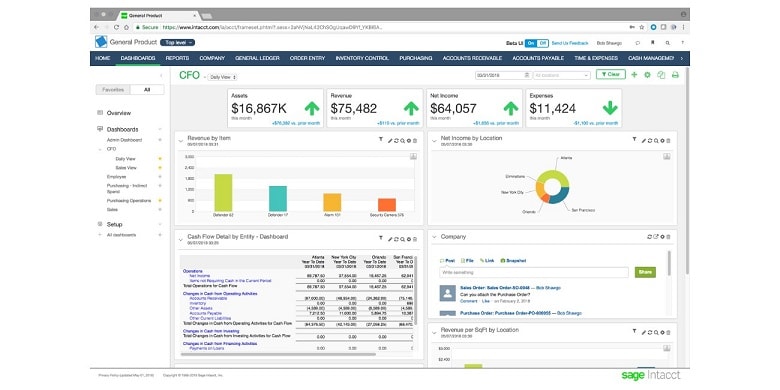

Sage Intacct

It is one of the expert financial cloud applications in the world. Besides Enterprise Resource Planning and accounting, it also helps in devising and evaluating the human resources and administrative facilities for various kinds of clients.

It has a wide range of merits, for eg, upgraded performance, which provides a huge support in automating and centralizing the significant finance procedures, control panel, and reporting.

It helps in accessing actual cooperation, exact analysis, and reciprocal visual prompts, and handles simple billing. Sage Intacct is also popular for producing new products every year.

Top Advantages of Sage Intacct

- Utilizing the automation eliminates the accounts payable refining time.

- Accelerates everyday monetary transactions and makes the cash cycles much more efficient.

- Makes the work related to the accounts book easier with the help of a General Ledger strengthened by Artificial Intelligence.

- Utilizing this accounting software’s feature- Multi-tax, it simply adheres to the tax necessities.

- Utilizing the inventory management structure helps in affirming the quality of stock versions.

- Provide support in automating the execution of returns recognition.

- Utilizing the time and expense handling advantages helps to monitor the billable hours and expenditures.

Cost-Structure

Sage Intacct also has a determined pricing pattern, i.e., its cost is fixed.

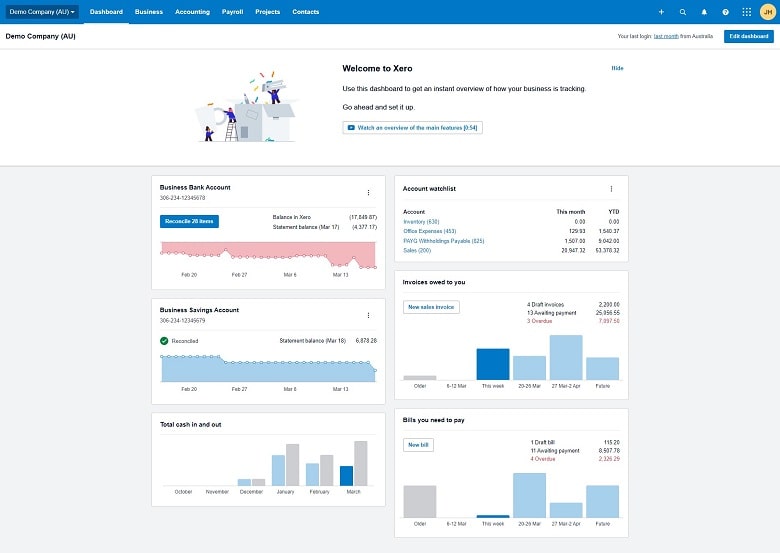

Xero

Miniature businesses, financial analysts, and bookkeepers can easily access the accounting software provided by Xero. It helps in making the business easy by automatically executing the human responsibilities, organizing the data according to the recent laws, and establishing a platform for cooperation.

Simultaneously, its source permits links to the majority of third-party applications. Furthermore, it possesses particular tools for retailing and development businesses, Amazon retailers, and charitabilities.

Top Advantages of Xero

- Create multi-currency data output with its reporting structure.

- Regulates and systemizes invoices and digital payments by automation.

- The data output sheets for sales tax returns and expenses can be automated and performed without the use of paper.

- Spontaneously, helps in analyzing the protected bank feeds.

- Collectively, does grouping of the bank transactions.

- Handles data and analysis of recent financial trends.

- Simply, provides assistance in tailoring the reports and trail inventory. It also helps to customize the buying commands on a vast scale.

Cost-Structure

Xero provides three pricing plans-

- The Beginner Plan ($25/month)

- The Medium Plan ($40/month), and

- The Premium Plan- ($54/month).

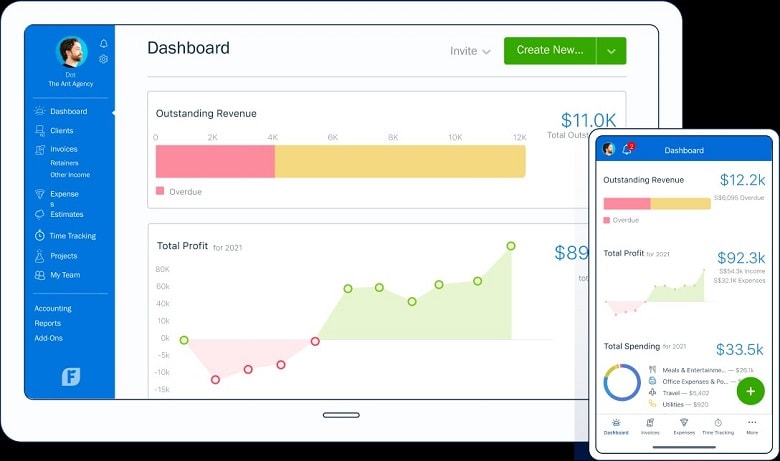

FreshBooks

This accounting software is for the use of self-reliant experts, independent contractors, beginning enterprises, and developed businesses.

A commodity of a four-person design unit that wants to make accounting easy for the partner miniature business proprietors, this source is well-versed in offering continuous, concurrent accounting tools.

Simultaneously, it displays a wide range of benefits for fundamental and high-tech accounting, analyzing expenses, tax preparation, along digital billing. FreshBooks also helps in integrating data across different platforms, generates custom charts of accounts, and produces automatic financial reports.

Top Advantages of FreshBooks

- Through automation, unrestrictedly, take payments and keep track of it.

- Utilizing the expense analytics pattern helps to check the expenses and receipts.

- To affirm high efficiency, it easily collaborates with clients.

- Helps in performing automated log mileage and provides reports related to billable hours.

- Coherently adjoin accounts to the Bench accounting facilities.

- Centralize payroll procedures through integration with sources, such as Gusto.

Cost-Structure

This accounting software provides memberships based on the number of billable clients a consumer has per month. The cost pattern varies from $15/month to $55/month.

It parallely provides a custom plan to consumers who need highly extended benefits. The retailer has a 30-day free trial. You can verify the advantages of the platform.

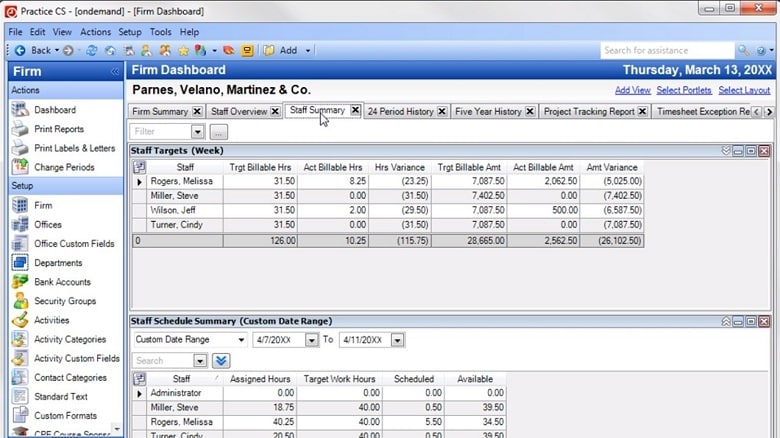

Thomson Reuters CS Professional Suite

It is a completely integrated application designed for miniature to gigantic business proprietors. Its suite offers various facilities, from the fundamentals of bookkeeping to consulting services which all execute collectively to uplift the financial work management.

The Account and Auditing commodity specifically provides three primary constituents:- a multi-functional application, a cloud-based audit handling application, a tax work report, and a trial balance application. These commodities can be further coupled with plugins even holding vital applications.

Top Advantages of Thomson Reuters CS Professional Suite

- Promotes flexibility relating to phone processing, software as a service, digital space, or on-premise utilization.

- Continuously integrate data from worksheets and additional sources to Computer Science.

- Makes easy cooperation with structures for promoting work efficiency and handling significant documentation.

- Tailors report according to the primary requirements.

- Collaborate with clients through clientele domains and various web sources.

- Prepares a platform for making the procedure of tax preparation easy, and enhancing the asset handling tools.

Cost-Structure

Quote can only access the CS professional suite. In addition, the retailer also offers a free-cloud-based trial of the source if you want something from which it has to provide.

TrulySmall Accounting

This accounting software is composed by Kashoo, which fulfills the needs of the miniature business entities, for eg, owner-managers, dealers, and self-employed beings.

It helps in accomplishing various difficult tasks of financial projects easily through automation. It provides a simple source to learn as a major advantage of the smart box is inhibited within it, which holds an appearance similar to an email inbox frontier.

This software broadcasts a customization setting which provides a huge help in enhancing your dashboard, and presents a free billing application for monitoring and reconciling cash distribution.

Top Advantages of TrulySmall Accounting

- Simply establishes the multi-currency platform for analyzing output data with many transformations.

- With the help of TrulySmall Invoices free application, it monitors billings and payments.

- Keeps updated about the actual sales and tracks sales tax on a vast scale.

- With the help of a double-entry ledger, it handles and cautiously stores data.

- Adheres to the IRS/CRA Principle CoA.

- Possesses the capacity to access the folders of more than one year in a very short time span.

Cost-Structure

TrulySmall Accounting’s pricing generally starts at $18/month in case paid every year. The retailer provides a 14-day free trial for individuals who want to check its processing prior to subscribing to the plan.

Conclusion

As above we talked about the top 7 accounting software in detail, now it would become easy for you to determine the best framework for your company as per your business needs and other parameters.

It is recommended to conduct a vast analysis of all the accounting software before adopting any one. It is important to understand the requirements of the company’s growth and act accordingly.

Therefore, only after a careful analysis, one should choose an appropriate model for the development of the business. Moreover, it is necessary to verify that the accounting tool you are adapting can be well utilized by the employees of the financial organization.